Renters Insurance in and around Malvern

Looking for renters insurance in Malvern?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It may feel like a lot to think through keeping up with friends, family events, managing your side business, as well as providers and coverage options for renters insurance. State Farm offers straightforward assistance and unbelievable coverage for your linens, tools and swing sets in your rented space. When mishaps occur, State Farm can help.

Looking for renters insurance in Malvern?

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

You may be questioning if Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the apartment. How difficult it would be to replace your belongings can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when fires or break-ins occur.

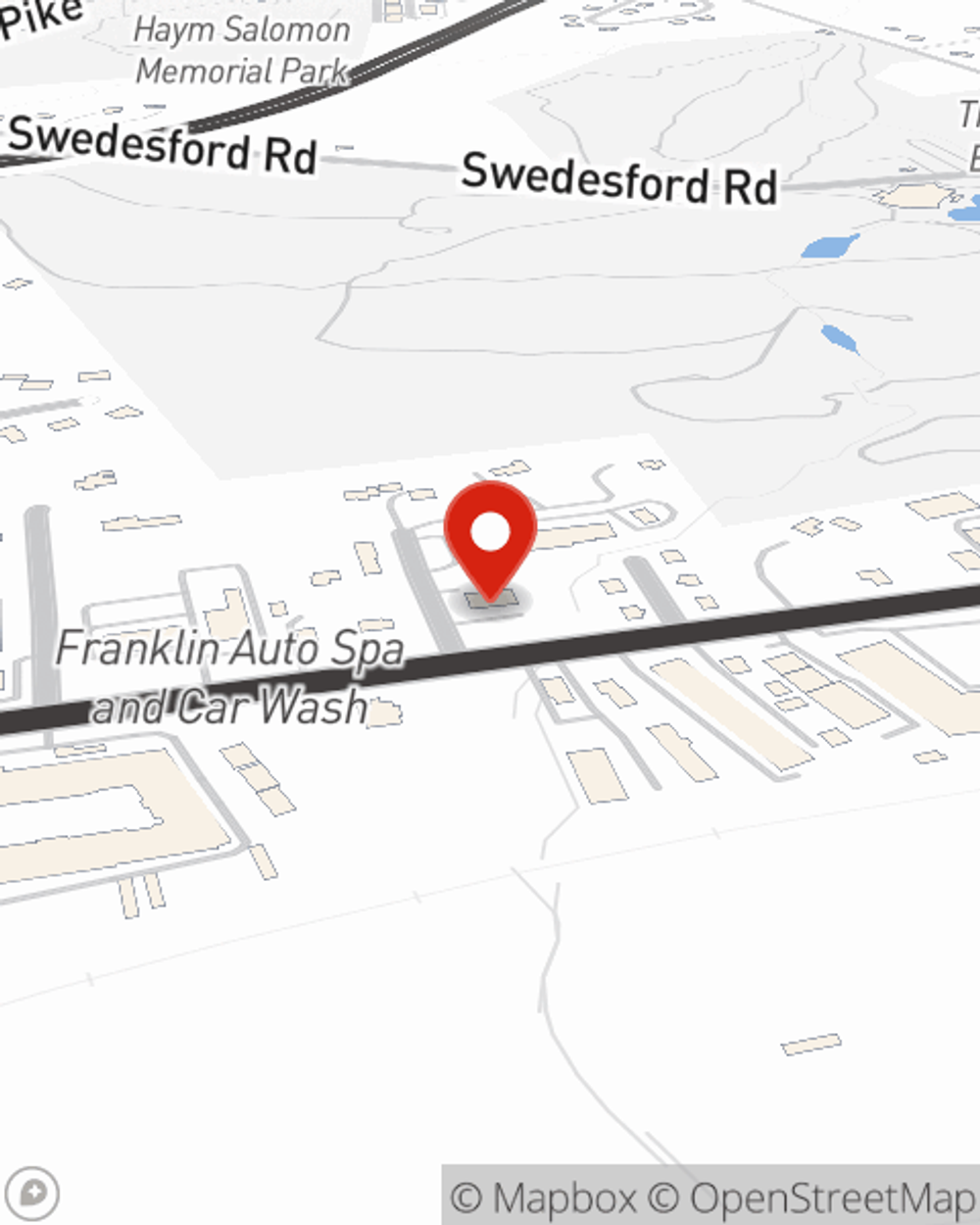

State Farm is a reliable provider of renters insurance in your neighborhood, Malvern. Contact agent Jim Dickey today for a free quote on a renters policy!

Have More Questions About Renters Insurance?

Call Jim at (610) 889-0909 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.